Simple Income Reporting

Review easy-to-understand profit and loss reports in your SmartCloud Tax portal.

Talk to Your Accountant

Schedule a call whenever you have a question or need advice about freelancer taxes, or shoot us a quick message.

Personalized Advisory

We guide you through your freelance journey and support you every step of the way.

Getting started is quick and easy.

1

Schedule your FREE 30 Minute Call with one of our experts.

2

Discuss the commission requirements you need to meet?

3

Review forms and documentation that are needed

Who is Self-Employed or Freelance?

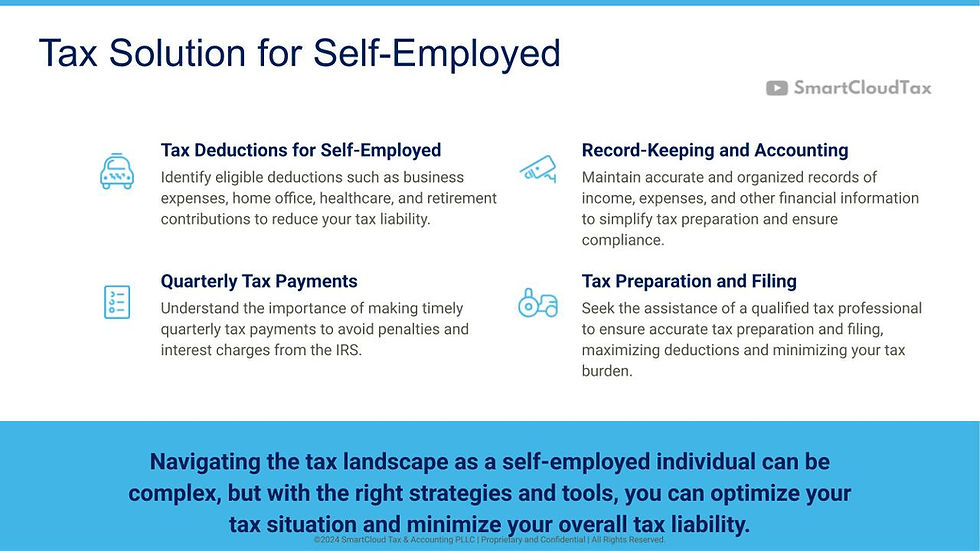

Managing all aspects of your self-employed business can be challenging. That's why SmartCloud Tax offers accounting services tailored for self-employed professionals. Our services are affordable, stress-free, and provide valuable insights to keep your business thriving.

Tax & Accounting Best Practices for Self-Employed & Freelancers

Track Income

Open a business bank account to create a single source of your self-employment income.

Track Expenses

Keep track of outgoing business expenses, which are the normal costs incurred for doing business.

Calculate Net Income

Take your gross income and subtract expenses to calculate.

Following Up on Invoices

Ensure your business income is uninterrupted while decreasing the volume of past-due notices.

Federal Form W-9

Form W-9 provides your Taxpayer Identification Number to the person who must file an information return with the IRS.

Schedule C (Form 1040)

Schedule C (Form 1040) reports income or loss from a business you operated or a profession you practiced as a sole proprietor.

Schedule SE (Form 1040)

Schedule SE (Form 1040) calculates the tax due on net earnings from self-employment. The Social Security Administration uses the information from Schedule SE to determine your benefits under the social security program.

1099 Forms

1099 Forms are a group of forms used to document payments made by your small business.

1099-MISC

Use Form 1099-MISC to file for each person you have paid during the year.

Form 1040-ES

Form 1040-ES calculates your estimated taxes.